IES Payroll Implementation T02: Oil Palm Plantation

(Estates)

OVERVIEW

The purpose of this document is to provide an overview of

the T02 IES Payroll Implementation for Palm Oil Plantation (Estates).

Introduction

This Payroll implementation, while performing intricate

and comprehensive processing, is designed specifically to present the following

characteristics: -

q

Ease of use, easy to administer, minimum effort to

maintain and operate

q

Fail-safe and robust operation, with undo options

Primary Topics

We will briefly deal with the following topics in the

overview, and detail in each case is provided in a separate tutorial or

document.

q

Implementation Setting

q

Payroll Types

q

Payroll Groups

q

Earning and Deduction Codes

q

Rule Objects

q

Set Up Parameter Settings

q

Payees

q

Harvest Bonus Administration

q

Payroll Steps (Perform, Undo, Error Report)

q

Pay Slips and Pay Schedule

q

Pay Result Reports

q

Other Reports

q

Enquiries

q

Admin Options

q

Inputs to the Payroll

Earning

and Deduction Codes

Man

Journals (Physicals)

q

Pay Calculation

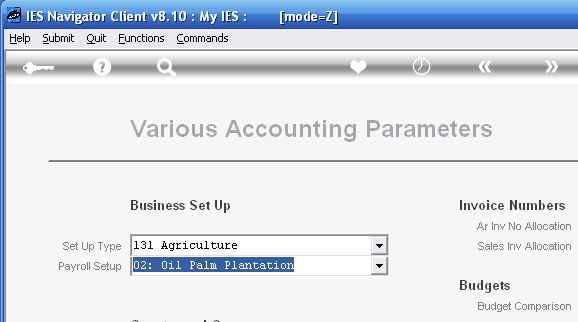

Implementation Setting

For this Payroll Implementation to be available in IES

Business, it requires the choice of this setting in the system settings, at

Accounting Controls, File Maintenance, Various Accounting Parameters.

![]()

Payroll Types

It is necessary to define at least 1 Payroll Type, i.e. a

Payroll from which Employees can be paid.

The Payroll master record is essential for the Payroll to

function, and the definition detail is discussed in a separate tutorial.

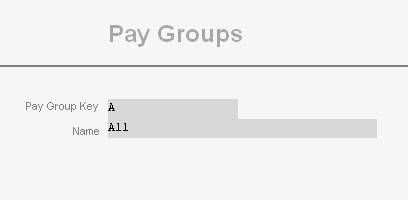

Payroll Groups.

Any number of Pay Groups may be applied, but at least 1 is necessary. Each Employee is registered as part of a Pay Group.

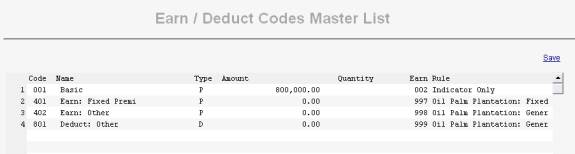

Earning and Deduction Codes.

Many Earning and Deduction Codes may be specified, but the

“001” earning Code for “Basic” is essential.

The Earning and Deduction Codes are discussed in detail in

a separate tutorial.

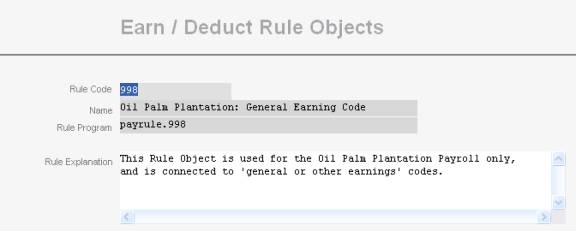

Rule Objects

Rule Objects determine how the Earning and Deductions

Codes function. They are already present, and simply need to be applied

correctly when new Earning and Deduction Codes are formulated. This too, is

discussed in more detail together with the Earning and Deduction Codes.

Set Up Parameter Settings

These consist of standard parameters to be specified for

Harvest Bonus calculation, Tax calculation and Natura Allowance calculation.

The parameter screens are not shown here, and the detail is discussed in a

separate tutorial.

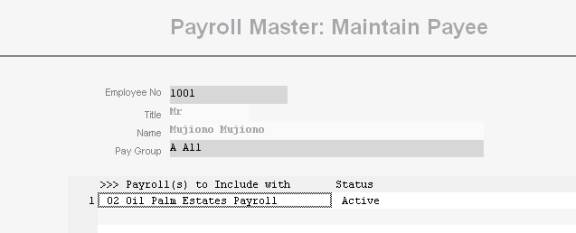

Payees

For an Employee to be paid, he or she must be registered

as a Payee on the Payroll Master.

How to set up an Employee on the Payroll register is

discussed in detail in a separate tutorial.

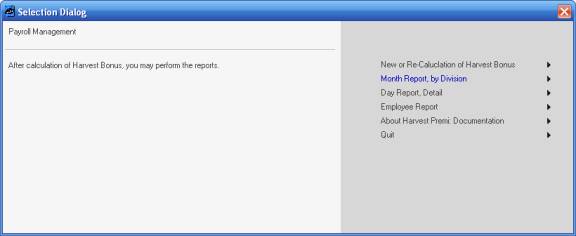

Harvest Bonus Administration

The Harvest Bonus administration is a sub system within

the Payroll, and which is used by the Payroll when the Payroll is performed, in

order to determine any Harvest Bonus amounts to be paid to Employees.

Harvest Bonus administration includes options to calculate

plus report options, and this is discussed in detail in the Harvest Bonus

document.

Payroll Steps

Payroll Steps consist of Perform, Undo and Error Report,

and these are unusually simple and easy to perform.

More about this in a separate tutorial.

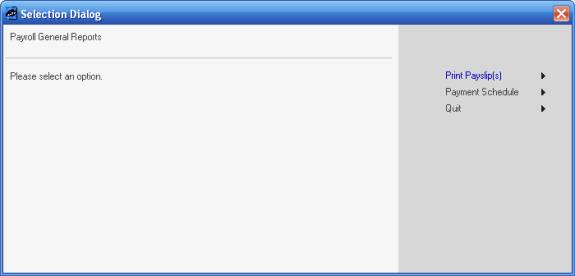

Pay Slips and Pay Schedule

Standard and flexible options for pay slip printing (all,

range, 1 and choice of stationery layout) and the Pay Schedule by Gang (group)

for Employee sign-off, are found at “Payrun Reports”.

This is also dealt with separately in a tutorial.

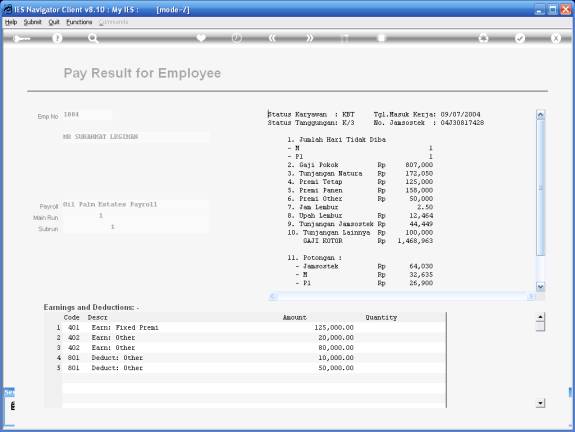

Pay Result Reports

This includes the various “result” reports of the various

earnings and deductions.

Other Reports

This includes a set of Master File reports related to

Payroll.

Enquiries

Enquiry options include “look only” options on Payroll

Master files, and of course an Employee Pay Enquiry where one can drill into

any Pay Record for the Employee, to discern the detail.

Administration Options

Administration options include a Payroll Diary,

Appointment Books and a Task Management system for Payroll. These are standard

options that work similarly to the same options in other IES Business modules,

but are in this instance dedicated to the Payroll desk(s).

Inputs to the Payroll (1): Earning and Deduction Codes

The Payroll calculation performs all the standard earnings

and deductions (i.e. those that are applied for all Employees) automatically

and transparently, and requires no administration or maintenance. In addition,

separate Earning and Deduction Codes may be applied where necessary, for

specific Employees. This is explained in the tutorial that deals with the

setting up of a “Payee”.

Inputs to the Payroll (2): Attendance Records

The Attendance Records administered in the Physicals

system are “read” by the Payroll in order to calculate Day Rates, Overtime

Rates and other criteria required by the Payroll to perform it’s standard pay

calculation per Employee. The Attendance Records system is discussed

separately.

Inputs to the Payroll (3): Man Physical Journals

The Man Physicals journals contain primary detail used by the Payroll for Bonuses, Harvest Bonuses and Overtime. The Man Physicals Journals are discussed separately.

Pay Calculation

The Pay Calculation automatically takes care of Harvest

Bonus, Bonus, Basic, Overtime, Tax, Premis, Jamsostek, Natura and the various

elements that are standard to Employees on this Payroll. The detail of how all

this is calculated and performed is detailed in a separate document.